Update Number 2:

On December 26, in a startling reversal, the Fifth Circuit halted the enfocement of the CTA Reporting Requirements Rule, reinstating the December 3rd injunction issued by the District Court for the Eastern District of Texas.

Urgent Update: Beneficial Ownership Reporting Deadlines Looming

Time is running out to comply with the new Reporting Requirements on beneficial ownership.

In a significant turn of events, the Corporate Transparency Act’s (CTA) reporting requirements have been reinstated following a federal Court of Appeals decision on December 23, 2024. The United States Court of Appeals for the Fifth Circuit lifted the nationwide preliminary injunction which prevented the enforcement of the Corporate Transparency Act (CTA), issued by the United States District Court for the Eastern District of Texas on December 3, 2024. This means that the CTA reporting requirements and deadlines are now back in effect.

This development is crucial for businesses across the United States, as it reactivates the obligation of most companies to report beneficial ownership information (BOI) to the Financial Crimes Enforcement Network (FinCEN) by January 2025.

Key Deadlines and Requirements

Existing Companies: If your company was created or registered before January 1, 2024, you have until January 13, 2025, to file your initial beneficial ownership report and comply with the CTA Reporting Requirements.

The reporting process generally requires companies to provide specific information about their beneficial owners, including:

- Name

- Date of birth

- Address

- Identifying document information

New Companies: Entities created on or after January 1, 2024, generally have 90 days from the date of creation or registration to comply with the CTA Reporting Requirements.

Consequences of Non-Compliance

Failing to comply with these new reporting requirements can result in severe penalties:

- Civil penalties of up to $591 per day for continued violations

- Criminal penalties of up to $10,000

- Potential imprisonment for up to two years

These penalties underscore the importance of timely and accurate reporting.

Ensure Compliance

To avoid potential penalties and ensure compliance with the CTA:

- Determine if your company is subject to the reporting requirements

- Identify your beneficial owners

- Gather the necessary information for each beneficial owner

- Prepare to file your report before the applicable deadline

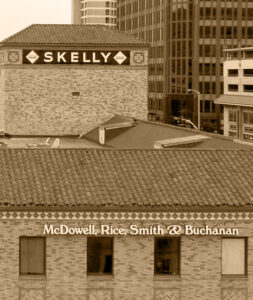

Contact Our Firm for Help

Navigating these new reporting requirements can be complex, especially for companies unfamiliar with beneficial ownership reporting. Our intellectual property law firm is equipped to assist you in understanding your obligations under the CTA and ensuring compliance with the new reporting requirements.We can help you:

- Determine if your company is subject to the reporting requirements (most are)

- Identify your beneficial owners

- Gather and organize the necessary information

- Prepare and review your beneficial ownership report

- Develop strategies for ongoing compliance

Don’t risk facing severe penalties for non-compliance.